A New Wave Of Customer Acquisition Coming To Markethive

Implementing a customer acquisition strategy is vital for any business looking to expand its customer base and foster long-term relationships with potential clients. This process involves attracting and nurturing leads until they are ready to purchase and ultimately converting them into loyal customers. A well-defined customer acquisition strategy helps businesses attract suitable leads and increases their chances of long-term retention.

This article delves into the significance of customer acquisition, its purpose, and practical strategies for achieving it. However, what sets it apart is the exploration of Markethive's role as a customer acquisition channel. Markethive is not just a platform; it's a specialist that helps businesses accomplish this crucial objective. Businesses can significantly enhance their customer acquisition efforts by understanding and utilizing Markethive's unique features.

Why Is Customer Acquisition Important? What Is Its Purpose?

Customer acquisition is a cornerstone of business success. It's the process of attracting and converting potential customers into loyal clients. But its importance goes beyond that. Customer acquisition is about expanding your customer base, boosting revenue, and building a robust brand reputation. You can grow your business and establish a steady income stream by acquiring new customers. Moreover, satisfied customers can become brand advocates, spreading positive word-of-mouth and attracting more customers. In essence, customer acquisition is a key driver of long-term business success.

This process also demonstrates traction to outside parties such as investors, partners, and influencers. Consistently attracting and converting new customers is vital for maintaining a healthy and growing business, which pleases investors. The goal of customer acquisition is to identify a repeatable and systematic approach to attracting customers to your business rather than relying on passive methods that may not ensure long-term profitability.

Customer Acquisition Channels And Strategies

Customer acquisition channels are the platforms businesses use to introduce their offerings to potential customers. These platforms can be organic search, organic social media, referrals, email, and more. Customer acquisition strategies can be categorized into paid and free, outbound and inbound marketing, and so on.

Content Marketing

Customer Acquisition Channel: Organic Search

Crafting captivating and pertinent content is a powerful strategy for attracting and engaging potential customers across various industries. By consistently producing fresh, exciting, and relevant content, businesses can effectively lure in their target audience and guide them toward their website, ultimately driving customer acquisition and growth.

Amid widespread deceptive advertising and declining consumer confidence, content marketing offers a gesture of goodwill by expressing, “We are passionate about our work and eager to provide our knowledge to you at no cost.”

Content marketing involves creating content relevant to your target audience and compelling them to act. The main goal is to connect with your audience and convert them into customers. This means each piece of content should have a clear call to action. Content marketing encompasses both creating content and promoting it effectively.

Blogging

Customer Acquisition Channel: Organic Search

Blogging is a valuable strategy for businesses of various sizes, sectors, and target audiences. Maintaining a blog allows you to delve into diverse subjects, showcase expertise in your field, and establish credibility with your readers. Through blogging, you can consistently interact with your audience by sharing visuals for them to save, posing questions for them to respond to, or presenting compelling calls-to-action for them to click on.

When launching a blog, it's essential to have a solid foundation in place to ensure its long-term success. This includes having a reliable team of writers, whether full-time employees, freelancers, or guest contributors. Additionally, having a graphic designer and editor on your team can help enhance your content's visual appeal and overall quality, making it more engaging for search engines and your target audience.

Social Media Marketing

Customer Acquisition Channel: Organic Social Media, Paid Social Media

Social media can require a lot of effort for little reward if you don’t develop a solid game plan for its use. What networks are you going to leverage, and which ones are you going to avoid? Posting organically on social media may seem like shouting into a void. The key is accessing the right networks, which all reach a well-defined audience.

Social media can be time-consuming and fruitless without a clear strategy. But with the right approach, it can be a powerful tool for customer acquisition. The key is understanding your audience and choosing the platforms that align with their interests. By doing so, you can maximize your efforts and feel empowered in your customer acquisition strategies.

For instance, if your target audience consists mainly of men, Pinterest may be less beneficial since only 15% of men use the platform. However, if your audience comprises millennials, it would be wise to incorporate Facebook, Instagram, and Snapchat into your social media strategy.

Video Marketing

Customer Acquisition Channel: Paid Search, Organic Social Media, Paid Social Media

Video production can be a complex process, but with the increasing affordability of high-quality cameras and the availability of freelance professionals, creating videos is more accessible than ever. Video marketing emphasizes the importance of high-quality content as a vital component of a comprehensive content strategy.

You can create engaging content for your audience by outsourcing script writing, editing, production, and animation to freelancers or production agencies. Video production's advantage is its versatility, allowing you to promote your content through various channels like search display ads, organic social media posts, and paid social media posts. Additionally, you can enhance your blog posts and pages by incorporating videos, which can better engage your readers and increase the chances of converting them into customers.

Email Retargeting

Customer Acquisition Channel: Email

The success of an email marketing campaign depends on more than just the content of the emails themselves. It's equally important to monitor the behavior of your email list and adjust your approach accordingly. For instance, when you gain a new subscriber, it's likely that they're interested in your business and want to learn more. However, if they do not engage with your initial emails, refining your approach by testing various calls to action to see what resonates with them is essential.

The clicks and unsubscribes in your email can offer valuable insights into your subscribers' preferences. The links they choose to click can indicate what they find most appealing, while those who opt out entirely can provide a glimpse into how your content is being received.

Sponsored Content

Customer Acquisition Channel: Paid Search, Paid Social Media, Traditional Advertising

Sponsored advertising takes various forms, from paid advertisements on search engine results pages (SERPS) to endorsements from influencers on social media platforms. Regardless of the platform you select, sponsored ads can help raise awareness about your products and services and draw new followers to your brand. You can explore various forms of sponsored content, like paid search results, product endorsements, and sponsored articles on relevant websites.

Customer Spotlights

Customer Acquisition Channel: Customer Referrals

Transforming satisfied customers into enthusiastic promoters can be a highly effective strategy for acquiring new customers. By empowering your existing customers to spread the word about your business, you can save time and money on other acquisition methods and tap into the credibility and trust they have established with their networks. This can lead to increased brand visibility, positive word-of-mouth, and, ultimately, the acquisition of new customers.

Invite customers to share their experiences. Seek out case studies, interviews, reviews, or user-generated content showcasing how your customers found your business and what makes it unique. Instead of promoting your company through paid advertising or social media, let your customers spread the word for you by sharing their stories.

Facilitate easy sharing of content. Although conveying a positive message can be effective, imagine the added value if your clients could readily distribute your generated content, such as social media updates, articles, or visual graphics.

Encourage a viral loop by having your customers share content that directs their followers to your business. Make it easy for them to share by providing Click to Share links for social media posts and including options to share via email. The easier it is for customers to promote your business, the higher the chances they will participate.

Search Engine Optimization

Customer Acquisition Channel: Organic Search

Search Engine Optimization (SEO) is a complex process that involves various strategies to improve the visibility of your content in organic search results. While not an exact science, there are established techniques that can assist in boosting your content's ranking. One essential aspect of SEO is creating content that search engines can easily access, interpret, and include in search engine results pages (SERPs).

To enhance your content's "indexability," you can include your primary keyword in the title of your post, provide alternative text for your images, attach transcripts to your video and audio materials, and create internal links within your website, which are essential for optimizing your content.

SEO has become a business's go-to customer acquisition strategy due to its ease and cost-effectiveness. As technology advances, SEO has become vital to marketing plans globally. Recent data shows that 64% of marketers actively invest in SEO, indicating its rising significance in the industry. Additionally, 75% of marketers believe their SEO tactics are highly effective in helping them accomplish their marketing objectives.

Product Pricing And Giveaways

Customer Acquisition Channel: All

More than words and promises may be required to persuade customers to purchase your products and services. Particular consumers may remain unmoved by influencer endorsements or recommendations from others. To attract these customers and build their loyalty, hosting giveaways allows them to risk-free sample your products or services. This hands-on experience can provide the necessary nudge for them to evaluate your brand as a viable choice seriously.

Another effective method of attracting customers is to utilize your product's pricing strategy, which can be promoted through every channel, including TV ads and customer referrals. You could also rely on your product's pricing to naturally draw in customers. This approach is particularly impactful if your competitors' prices are significantly higher or differ from your pricing model.

Craft Compelling Landing Pages

Customer Acquisition Channel: All

Developing optimized landing pages is crucial for attracting customers. This strategy involves enhancing specific pages on your website to guide visitors toward your offerings. These pages serve as a gateway to your product or service, guiding consumers toward taking action. A well-optimized landing page provides valuable insights and features a solid call to action to drive conversions effectively.

To sum up, these customer acquisition strategies are interconnected and complementary. For example, social media platforms can disseminate SEO-optimized content featuring a call to action, encouraging readers to sign up for an email list. In other words, they work together seamlessly.

Now that we’ve touched on the various customer acquisition channels and strategies, let's look at how this pertains to the Markethive concept, the direction, and how it will become an incredibly powerful social, marketing, and digital broadcasting platform.

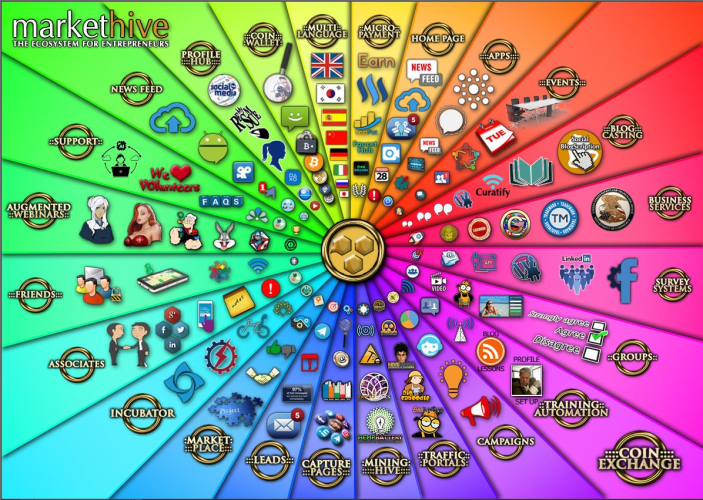

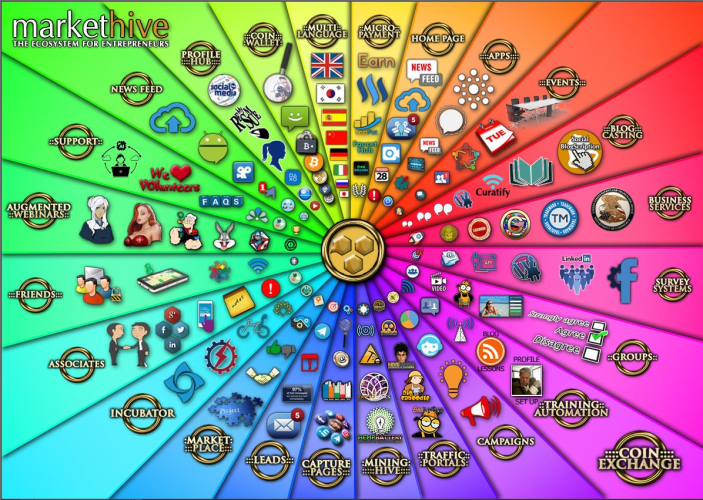

Markethive: The All-In-One Channel For Customer Acquisition

Markethive is poised to revolutionize the world of affiliate marketing, network marketing, and commission-oriented companies by introducing a groundbreaking Promocode system. This innovative approach, unprecedented in the history of marketing and customer acquisition, enables Markethive to create and offer customized promotional codes that can be redeemed for various valuable services, including money or cryptocurrency, press releases, banner impressions, targeted broadcasting, and more. By harnessing the power of these services, Markethive is providing a game-changing tool that can help businesses achieve unparalleled success.

We're revamping our dashboard services to feature a cutting-edge, multi-newsfeed interface. This upgrade will showcase innovative tools, including a page creation system, automated responders, tracking capabilities, backlinking technology, and blog broadcasting. These services are essential for every business and entrepreneur looking to thrive in today's fast-paced digital landscape.

Markethive is developing a system linking Promocodes to different subscription levels, groups, or individuals. Each entity is given a distinct code. These Promocodes will be incorporated into different websites under construction, like Hiveco.in. Every Markethive Entrepreneur One member will receive a personalized website with a unique code for marketing purposes.

Markethive's services and cryptocurrency giveaways will be promoted on these websites, and when prospects sign up, they will be connected with a designated entrepreneur and become their primary customer. This system rewards entrepreneurs with matching bonuses once the new member completes the KYC protocol, encouraging them to engage with the system. This is an exemplary example of inbound marketing.

As we progress and expand our services, including Hivecoin’s availability on exchanges and the upcoming ability for new customer acquisition with Promocodes, Markethive's inbound marketing services will become more appealing to companies, allowing them to establish a seamless connection with us through a socket connection.

Markethive is set to revolutionize the affiliate and network marketing industry by offering its services to support companies and affiliate programs. Through its innovative Co-op system, customers will be generated and shared among members who contribute to the system within a specific Markethive Storefront. Essentially, members who participate in the Co-op will buy customers, providing a unique opportunity for growth and success in the industry.

Customer acquisition is the equalizer to everyone in Markethive and beyond. Markethive, a thriving community for entrepreneurs, is progressively integrating blockchain technology with decentralized data servers in every country worldwide. Through its innovative blockchain-based ecosystem, Markethive creates a level playing field for all businesses. Its robust inbound marketing platform is constantly evolving, covering every facet of customer acquisition, which is the cornerstone of success for any company.

This marks the initial phase. All the customer acquisition channels and strategies mentioned above are incorporated into the Markethive platform or will soon be, such as our exclusive email system and web page hosting, SEO systems, every aspect of marketing, digital advertising, video advertising, broadcasting services for social networks, and broadcasting services for the Markethive Blog system. In upcoming articles, further developments and revelations will be shared, so stay tuned!

Join us every Sunday at 8 a.m. Mountain Time for our weekly meetings, where you'll get a front-row seat to witness Markethive's transformation into a dominant force in the digital marketing and acquisition landscape. The link to the meeting room is located in the Markethive Calendar.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

Tim Moseley

.png)

.png)